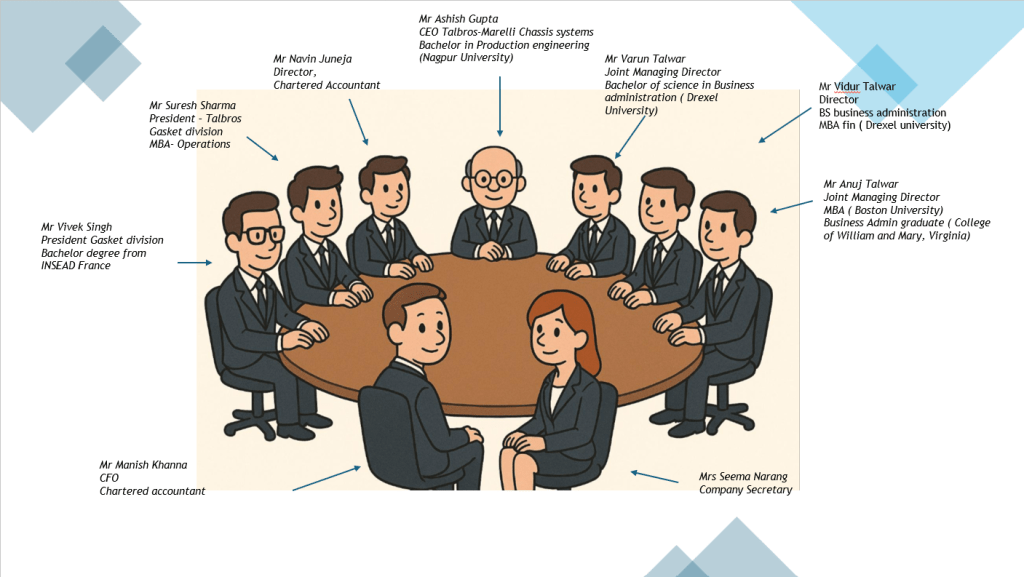

“Boards are the custodians of corporate conscience and long-term value.”

— Lucy P. Marcus

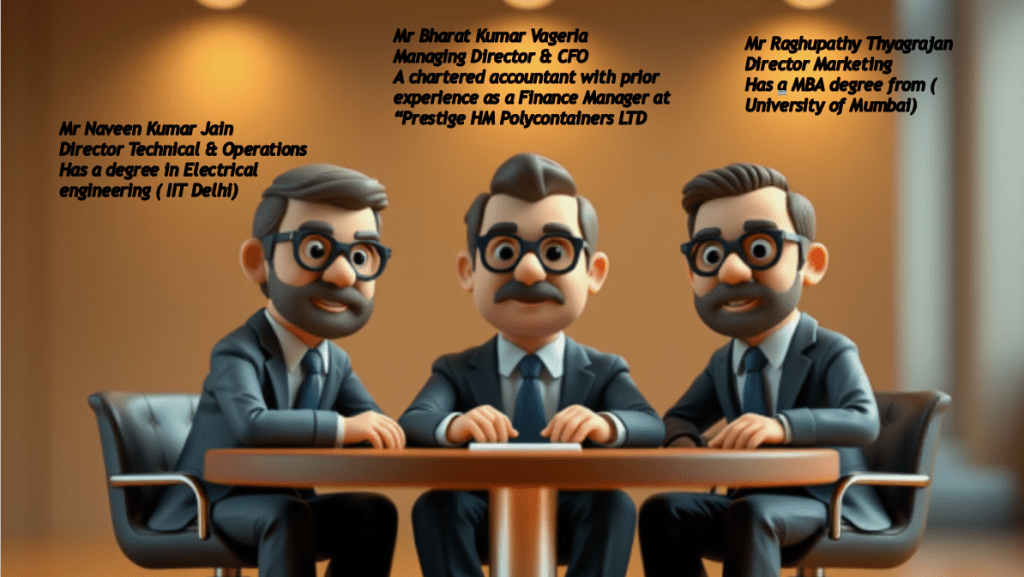

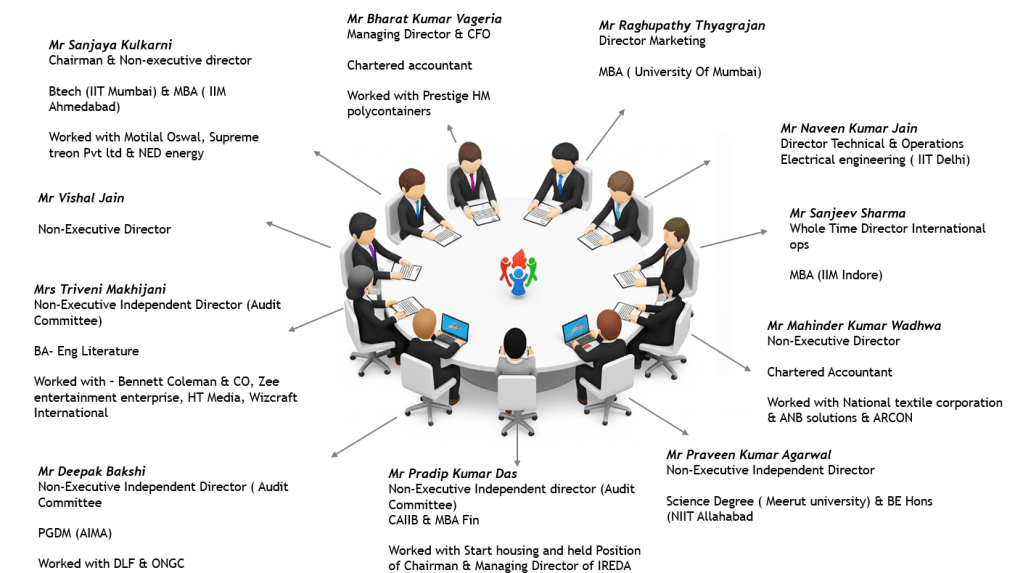

Focus On Management

Board of Directors

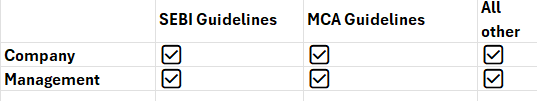

Compliance angle

Company has held analyst / Investor calls on a quarterly basis since past 5 years without any discrepancies

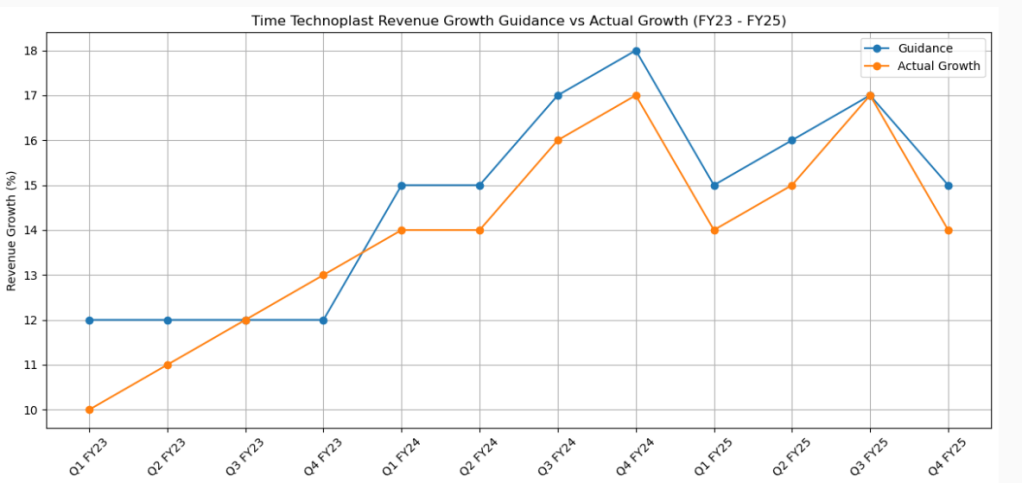

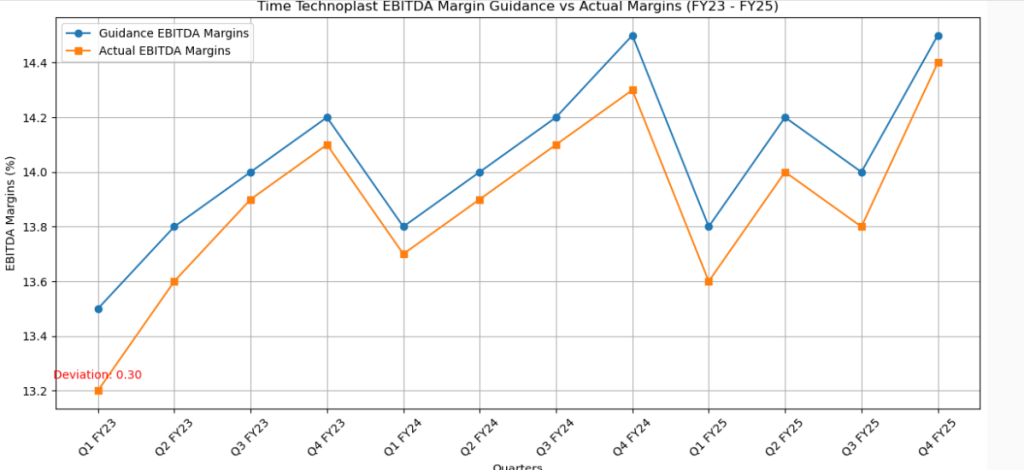

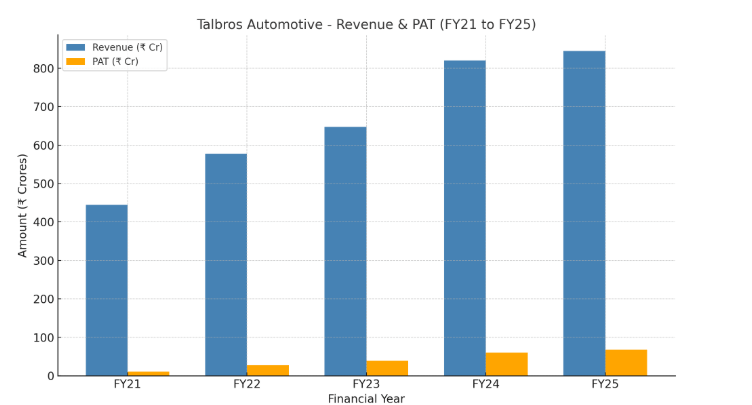

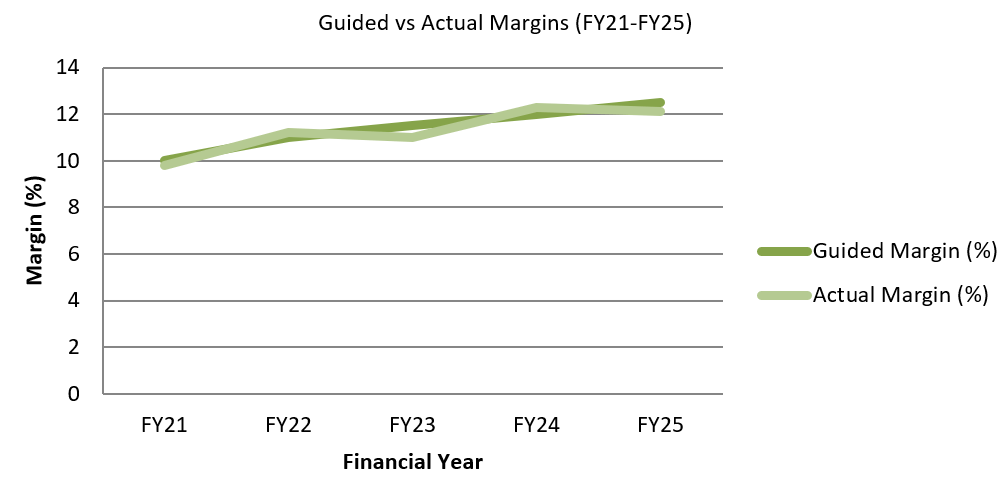

Key Financials

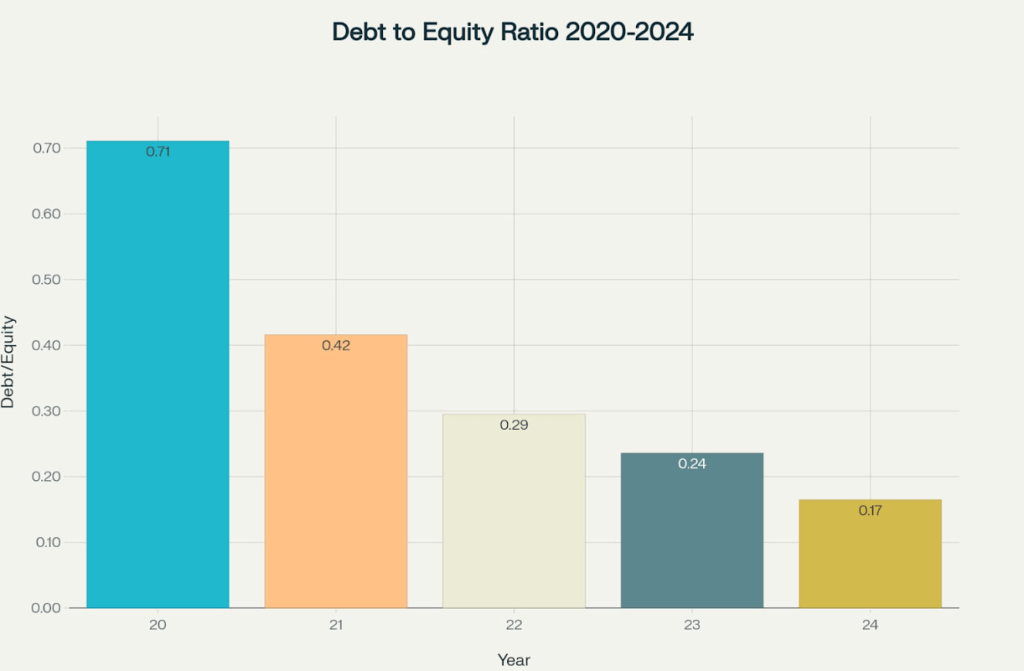

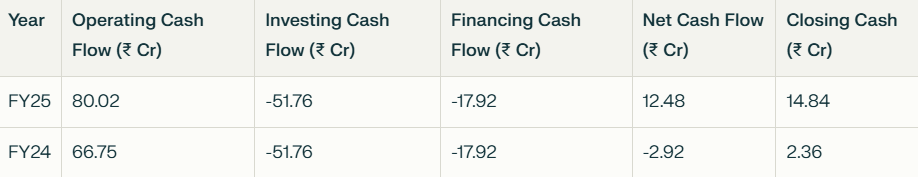

- Management has guided to keep Net debt level below 100cr by FY27

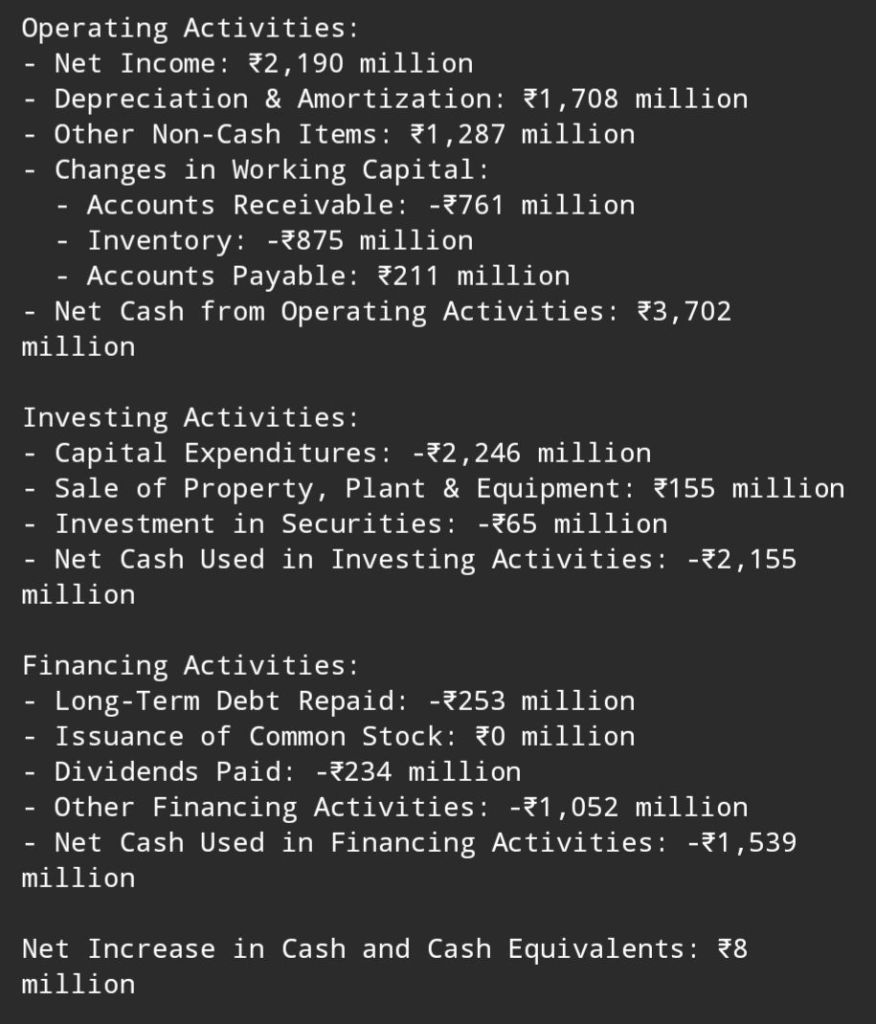

Cash flow

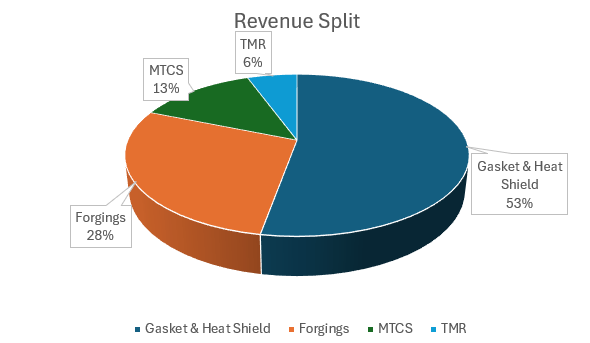

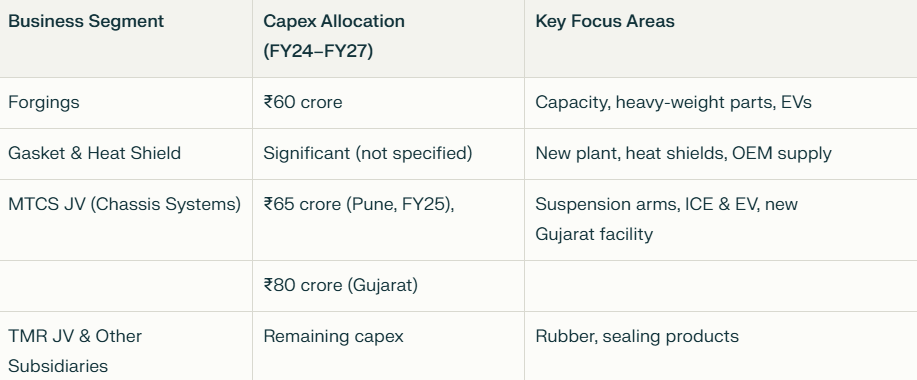

Capex Snapshot

- Guided for total capex of 205cr for next 3-4 years mainly funded by internal accruals,

*Source for above Financial data is submissions made by company to Stock Exchanges*

Focus area going forward

- Increase the share of exports in revenue from 25% to 35% by FY27.

- Increase in share of EV related components from 2% to 12% by FY27.

- Double annual revenue to 2200cr by FY27 backed by EV components and Exports.

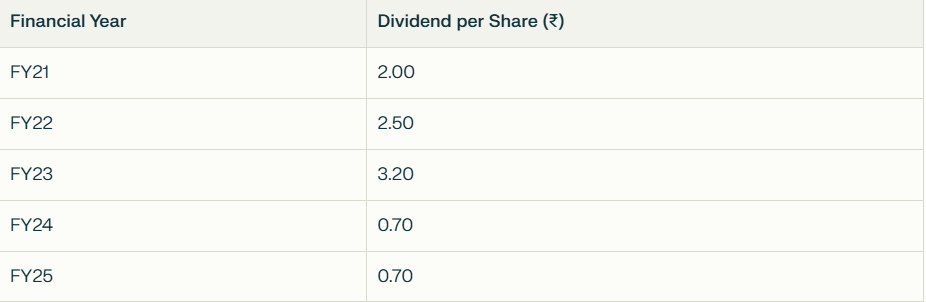

Dividend payouts ( Face Value 2)

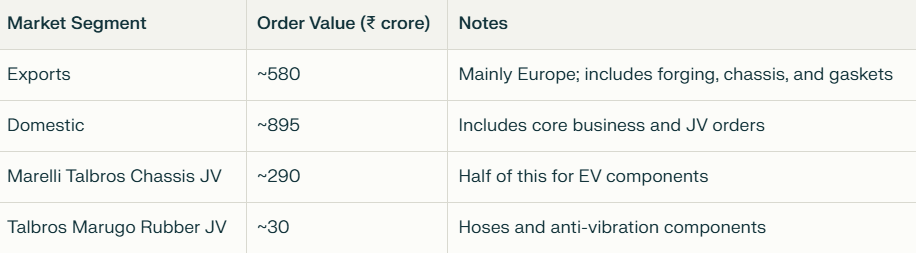

Order book snippet

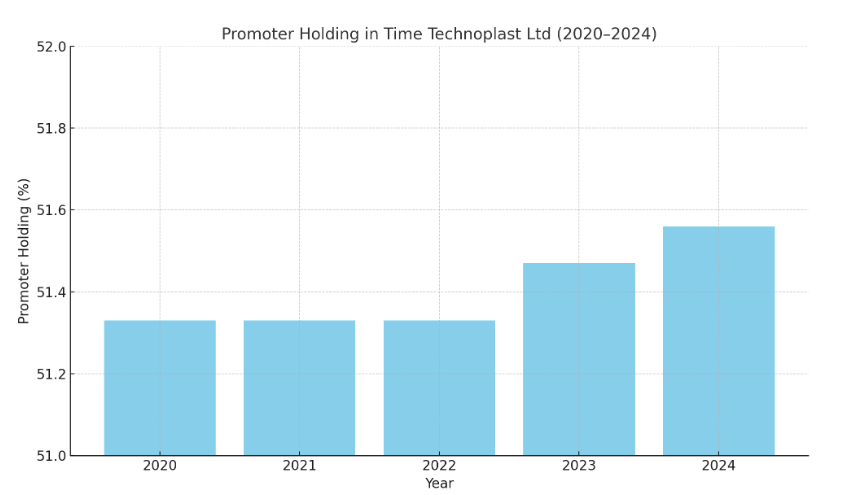

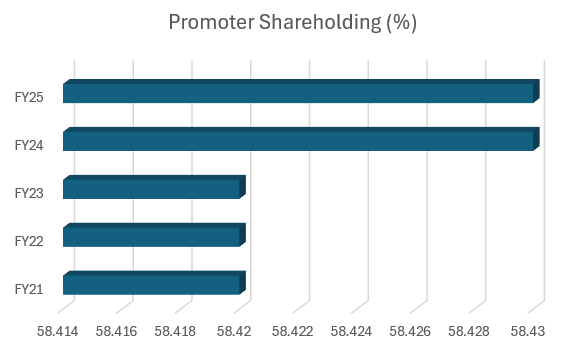

Promoters skin the game

Key Takeaways

- The overall industry growth for Forgings, Gaskets & Heat shields is expected to be 9,8%, 7% & 7.4 percent respectively on a CAGR basis.

- Company’s focus on these areas is a positive.

- While overall revenue has almost doubled from FY21 to FY25, company has faced challenges in recent years due to Supply chain issues, Increased expenses and overall Industry competition.

- As a result of slow growth in revenues & profits the dividend payouts are significantly lower in the recent two financial years.

- Also, the evolving situation around bankruptcy proceedings of Marelli will need to be looked at closely as it has a JV with Talbros.

- On the other hand strong order book and recent orders from new clients like Tata motors puts the company on a good note to achieve their guided numbers.

- Available at a market cap of 1793 crores with a PE of 19.

While there are challenges considering the entire geo political and tariff situation but, the valuation, debt levels and governance metrics provide the cushion on which one can take a bet on this company.

PS: Please contact your financial / investment advisor before taking any decision.

Good corporate governance may not necessarily translate into good investment returns but it surely ensures safety of capital and peace of mind to a decent extent

Do also drop in your feedback or a company you would like to be researched in this manner by reaching out on

governmint286@gmail.com