This post is nothing like your typical research with a target price, it focuses more on the governance & management related information of the company.

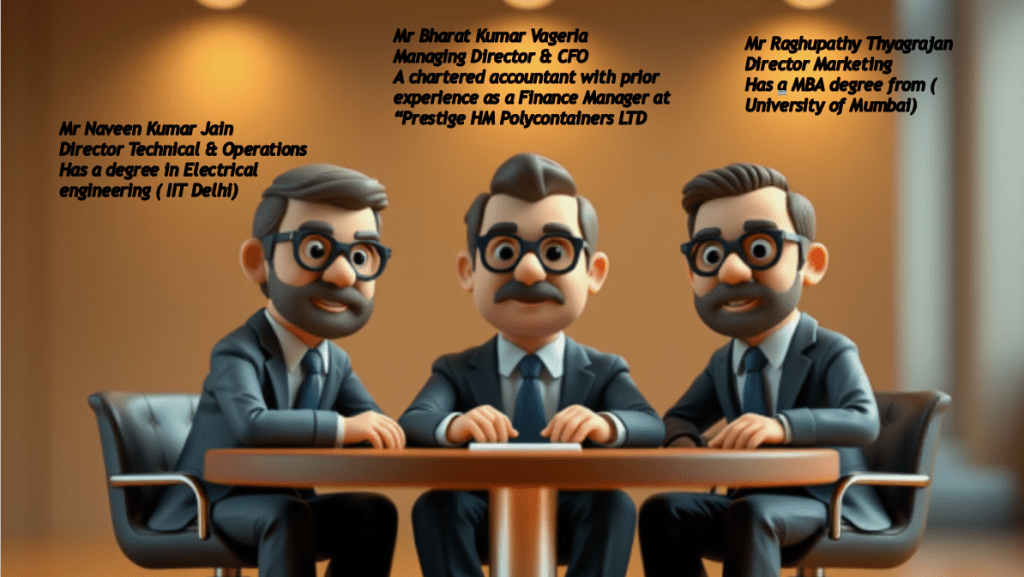

Focus on Management ( Founding team)

The above three people are part of the founding team of Time Technoplast along with Late Shri Anil Kumar Jain.

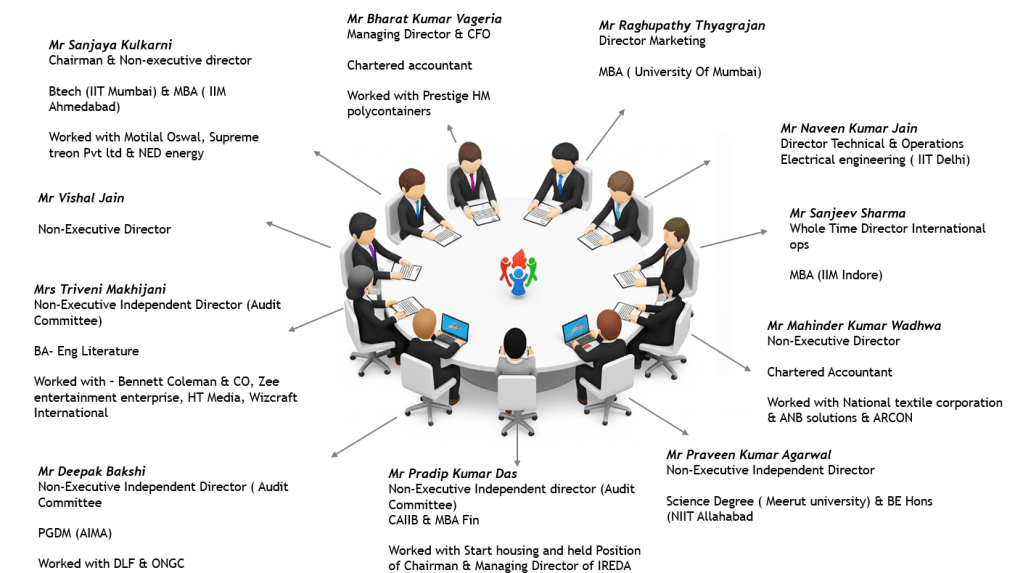

Board of Directors

Compliance angle

There are no penalties imposed by SEBI, and Time Technoplast is fully compliant with SEBI regulations.

There are no major enquiries or penalties imposed by MCA as well on the company.

Also, there are no records of any Inquiries or complaints either against the Promoters or any members of board.

Investor Facing points

The company is holding Analyst/Investor conference calls as per provided guidelines in the law at the end of every quarter.

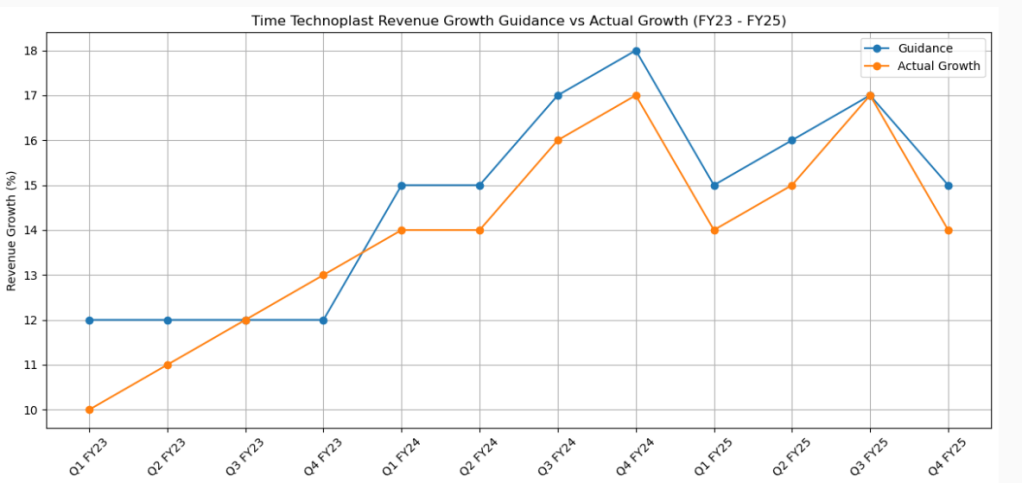

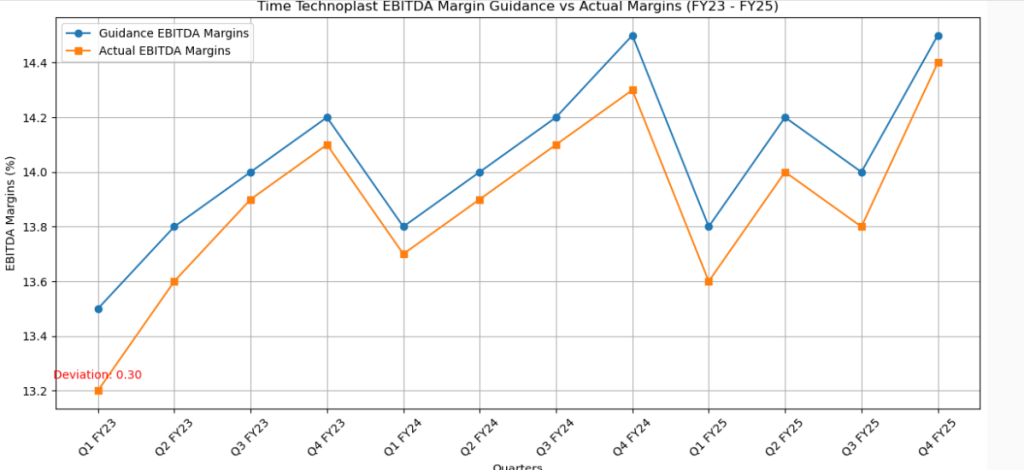

The management has also been very realistic with their Guidance/Outlook and has also consistently more or less achieved those over the past years.

Other Business information

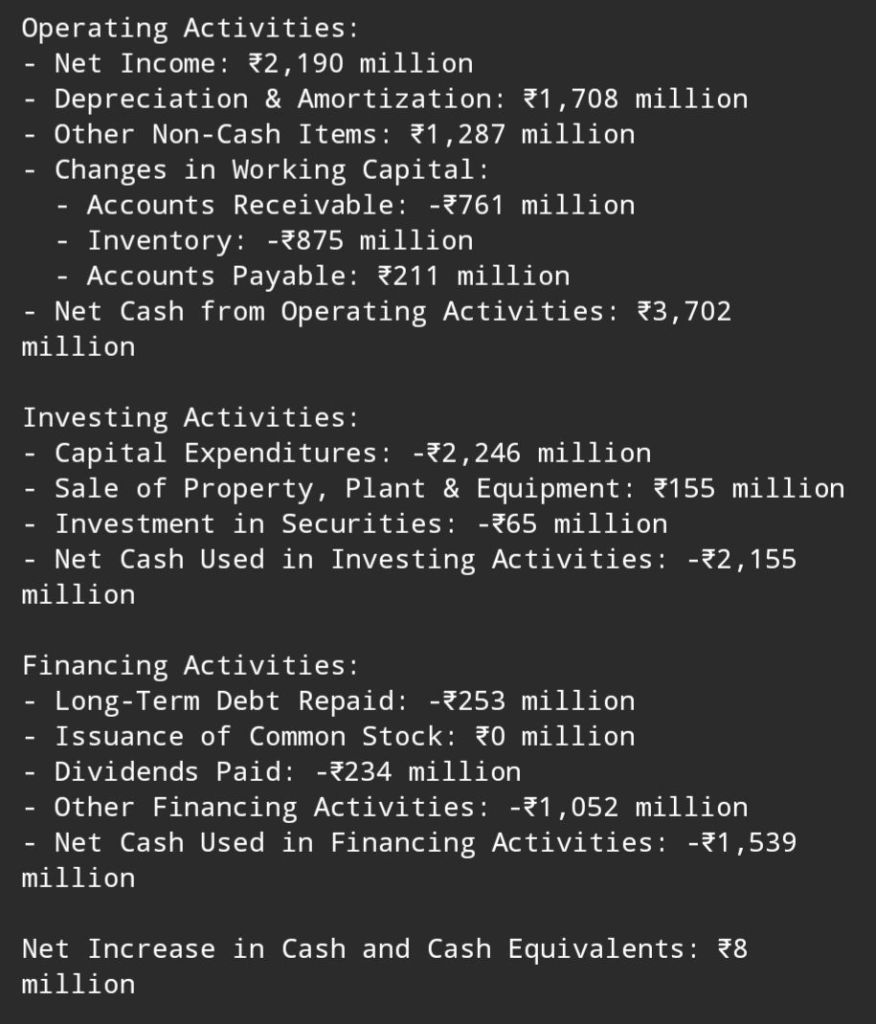

Company as been earning decent cash flows from its existing legacy business and is continuously using those to fund their Capex, R&D , new business ventures.

They have also put up a new venture to tap in to recycling of Industrial Plastic (30k-40k Cr value worth market). This, will not only help them contribute to their sustainability goals but also act as a backward integration for raw material to them. All this while they maintain on track to be a Net debt free company by 2027.

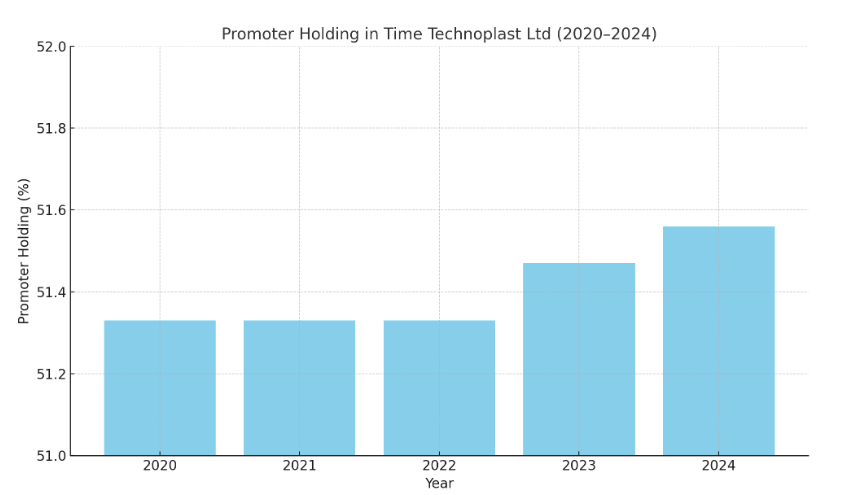

Promoters skin in the game

Promoters holding seems to be consistent with a slight uptick in recent years.

Good corporate governance may not necessarily translate into good investment returns but it surely ensures safety of capital and peace of mind to a decent extent

Do also drop in your feedback or a company you would like to be researched in this manner by reaching out on

governmint286@gmail.com

Leave a comment